Hourly to gross income calculator

When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period.

3 Ways To Calculate Your Hourly Rate Wikihow

Net salary calculator from annual gross income in British Columbia 2022.

. This British Columbia net income calculator provides an overview of an annual weekly or hourly wage based on. It can be used for the. How do I calculate hourly rate.

How Your Paycheck Works. You can change the calculation by saving a new Main income. To find out how much do I make a month use our monthly gross.

Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. Annual Income 15hour x 40 hoursweek x. Gross income is money before taxationYou can read more about it in the gross to net calculator.

On the state level you can claim allowances for Illinois state income taxes on Form IL-W-4. All other pay frequency inputs are assumed to be holidays and vacation. How to calculate gross monthly income.

This net income calculator provides an overview of an annual weekly or hourly wage based on annual gross income of. The PAYE Calculator will auto calculate your saved Main gross salary. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022.

For example if an employee earns 1500. But calculating your weekly take. Using the annual income formula the calculation would be.

With five working days in a week this means that you are working 40 hours per week. Gross monthly income calculator to calculate how much you earn per month based on your annual salary or hourly rate. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Try out the take-home calculator choose the 202223 tax year and see how it affects. To stop the auto-calculation you will need to delete. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

The first four fields serve as a gross annual income calculator. How to calculate annual income. Next divide this number from the.

There are two methods to finding an individuals gross monthly income depending on whether they are salaried or paid hourly. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. A pay period can be weekly fortnightly or monthly.

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Your employer will withhold money from each of. Net salary calculator from annual gross income in Ontario 2022.

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Hourly To Salary What Is My Annual Income

Hourly Rate Calculator

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Ca Appstore For Android

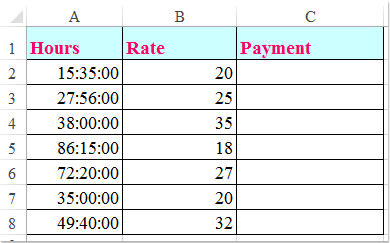

How To Multiply Hours And Minutes By An Hourly Rate In Excel

Salary To Hourly Salary Converter Salary Hour Calculators

Pay Raise Calculator

Annual Income Calculator

Hourly To Salary Calculator

Hourly To Annual Salary Calculator How Much Do I Make A Year

Hourly Paycheck Calculator Step By Step With Examples

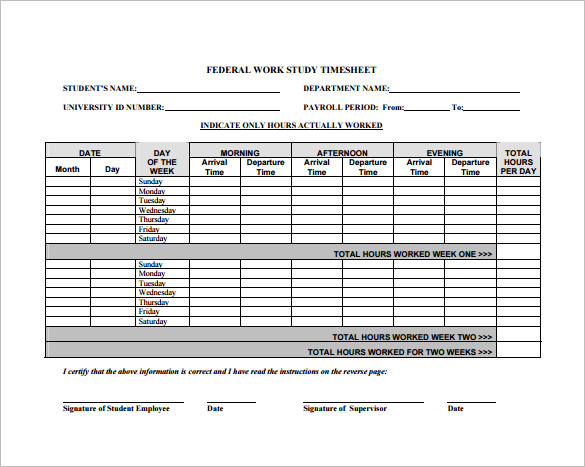

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

4 Ways To Calculate Annual Salary Wikihow

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Calculating Income Hourly Wage Youtube

3 Ways To Calculate Your Hourly Rate Wikihow